tax shield formula uk

Without the depreciation tax shield the company will have to pay 250000 in taxes as it has a 25 tax rate and 1000000 in revenues. If feasible annual depreciation expense can be manually calculated by subtracting the salvage.

Finan 3040 Chapter 9 Flashcards Quizlet

Class 13 original lease period plus one renewal period.

. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Web formula shield tax uk. The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Minimum 5 years and Maximum 40 years Class 14 Length of life of property. The formula for calculating the interest tax shield is as follows.

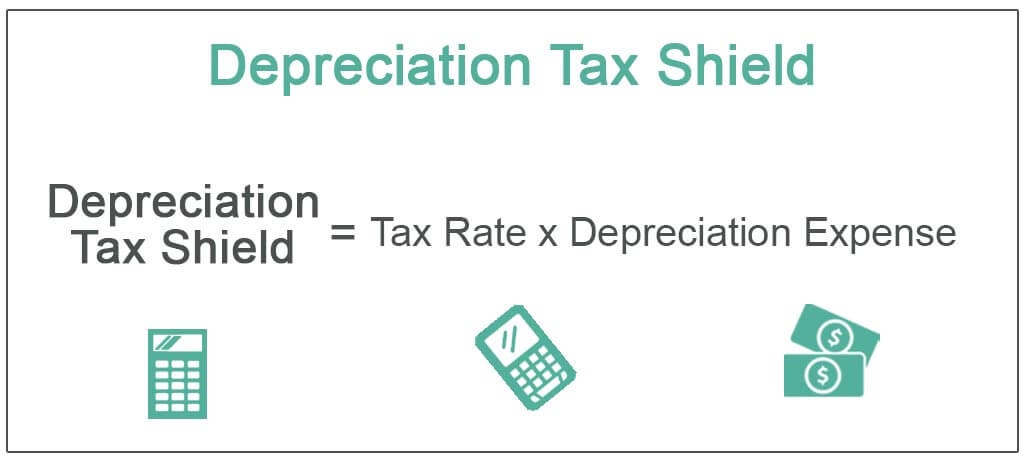

Depreciation Tax Shield Formula. On the other hand if we take the. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. For instance if the tax rate is 210 and the.

Tax Shield Amount of tax-deductible expense x Tax rate. Or the concept may be applicable but have less. Tax Shield formula.

Web A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. 1 For example because interest on debt is a tax-deductible expense taking. Interest Tax Shield Formula.

What is the formula for tax shield. The formula for this calculation can be presented as follows. Web formula shield tax uk.

Interest Tax Shield Interest Expense Tax Rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest. Web Tax Shield Deductible.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Depreciation Tax Shield Depreciation Expense Tax Rate. Companies using a method of accelerated depreciation are able to save more money on tax payments due to the.

Class 36 up to 1007o.

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Tax Rate And Non Debt Tax Shield

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Pdf Tax Rate And Non Debt Tax Shield

Tax Shield Definition Formula Example Calculation Youtube

Interest Tax Shield Formula And Calculator Step By Step

Formula E Unplugged Fia Formula E

Pdf Debt Tax Shields Around The Oecd World

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Formula Step By Step Calculation With Examples

Discount Rate Formula Definition How To Calculate It

Next Level Racing Gtelite Formula And Hybrid Pedal Upgrade Kit Dell Usa

Tax Shield Calculator Efinancemanagement

What Is The Depreciation Tax Shield The Ultimate Guide 2021